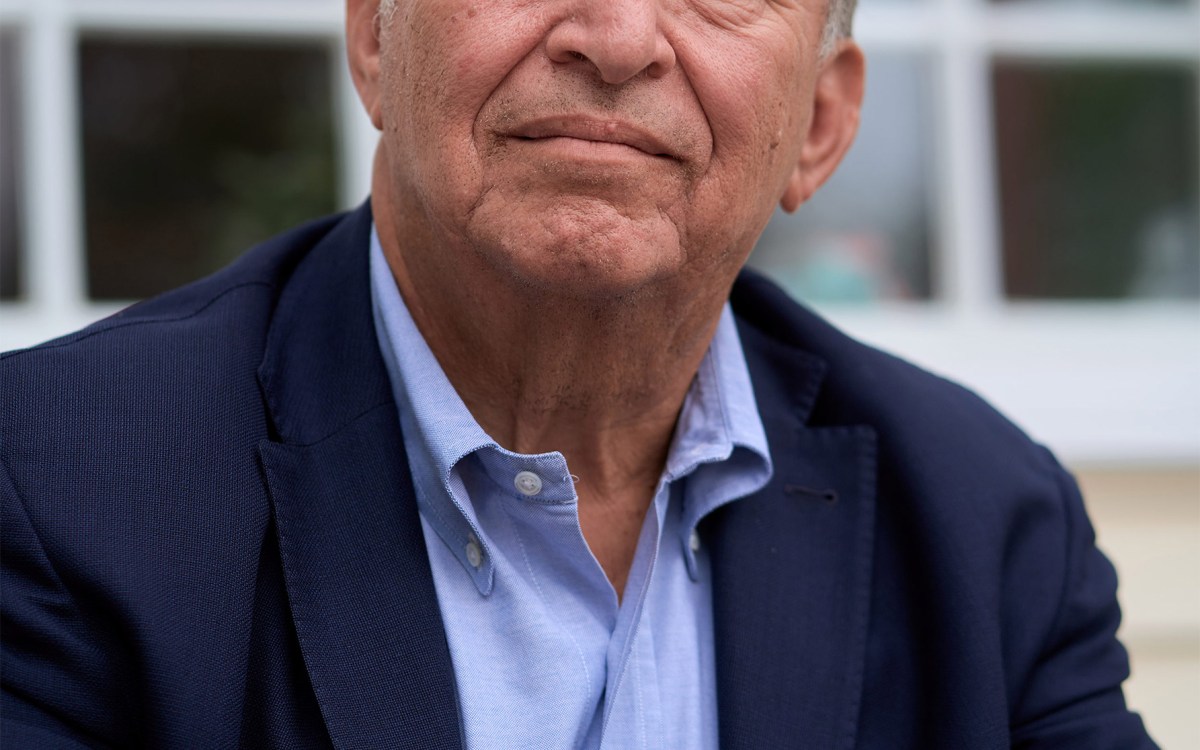

Lawrence H. Summers, former Secretary of the Treasury and president emeritus of Harvard, discusses the economy during a Kennedy School talk. He’s joined by alum Linda Pizzuti Henry, managing director of Boston Globe Media Partners.

Photo by Martha Stewart

Fed needs to get tough on rates now, Summers says

New report shows consumer prices rising, he says. Central bank needs to control inflation, soften blow of expected recession.

It’s time for the Federal Reserve to take an honest appraisal of the economy and start raising interest rates more aggressively to bring soaring inflation under control and perhaps soften the effects of a looming recession that appears unavoidable.

That’s the recommendation of Lawrence H. Summers, the Charles W. Eliot University Professor and former secretary of the Treasury under President Clinton, in the wake of last week’s report revealing another uptick in consumer prices, data that rattled hopes for an imminent slowdown in inflation and sent financial markets reeling.

The president emeritus of Harvard discussed the ongoing economic crisis and what the current administration can do to soften it during an Institute of Politics Forum on Thursday with Linda Pizzuti Henry, M.C./M.P.A. ’21, managing director of Boston Globe Media Partners.

After a July report that showed no change from the prior month, some analysts harbored hopes for better news from the August consumer price index. Instead it increased 0.1 percent, with prices 8.3 percent higher than a year ago.

“There are different kinds of prices,” Summers said. “There are the prices of wheat or gasoline or airline tickets, and there are prices like tuition at Harvard. And one kind of price bounces up and down a lot, and the other kind of price reflects an underlying trend in momentum.” While the current, apparently better news reflects the decline in the more volatile prices, he explained, the underlying trend is toward more inflation in fundamentals. “And the most fundamental are the wages people are getting,” he said, noting that inflation of “those prices is running at 5 percent or 6 percent a year.”

While “headline inflation” appears to be slowing, “if you want to be thinking straight you want to look at underlying inflation where inflation is running somewhere in the range of 5 percent.” He said that rate translates to a level “where prices double every 14 years, and inflation is eroding people’s real wages. That’s why inflation is the greatest concern that Americans are feeling right now.”

Aggravating the problem, he said, is an overly cautious response by the Federal Reserve.

“Gradualism and tentativeness are not the best approach,” he said. “We must be firm and resolute.”

What that means exactly isn’t clear, although the current Fed forecast that it will have to raise rates by 75 basis points “is better than doing only 50 points.”

“My feeling is they’re going to have raise rates more,” he said. “I think it would help if the Fed were more realistic and honest.

“Belatedly the Fed has realized that inflation control has to be its primary policy priority,” he said.

“Gradualism and tentativeness are not the best approach. We must be firm and resolute.”

Lawrence Summers

Summers has been sounding the alarm for some time that the Biden administration’s pandemic stimulus plan was perhaps too generous and that the nation was headed for trouble.

“I looked at the data as I saw it 18 months ago in February 2021,” said Summers. Noting a 2 percent to 3 percent gap between the actual and potential gross domestic product and the fact that roughly 14 percent of the GDP came from Biden’s fiscal stimulus, “I thought, ‘This bathtub is going to overflow pretty badly.’ We’re likely to be overstimulating the economy, and that’s going to generate substantial inflation.

“Sure enough, before long we got to a situation where the ratio of vacancies to unemployment was three times as high as it normally had been, and everywhere you walked you saw shortages of labor, and you saw bottlenecks.” Describing this as an inflationary environment, he saw a building crisis that “wasn’t going to subside of its own volition.”

While some economists point to global supply-chain problems as a primary cause of inflation, Summers disagreed that pandemic blockages were a primary cause. “There were bottlenecks,” he acknowledged. “But one of the reasons there were bottlenecks is that there was so much demand” from U.S. consumers made cash-rich by pandemic relief.

At this point, Summers said a recession is inevitable. “I calculated some time ago that there’s never been a moment when we’ve had inflation above 4 percent and unemployment below 4 percent, and we didn’t have a recession within two years,” he said. “That’s why I think the idea of a soft landing is the triumph of hope over experience.”

Asked what the Biden administration can do to ease inflation or soften the impact of a coming recession, Summers presented limited options. Reducing deficits would be one constructive step, he said, as would “doing whatever you can on the supply side.” Along these lines, he repeated his familiar call for deregulation, describing how bureaucracy can slow both growth and trade. However, he acknowledged, these steps are “less important than monetary policy.”

“The right posture for the president in general with respect to monetary policy is to respect the independence of the Fed and that monetary policy is the best determinant of inflation, and to keep politics out of it,” he said.